Superannuation

What is Superannuation?

Superannuation (Super) is money for your future retirement. It is currently the most tax-effective long-term savings structure available in Australia, and is ultimately designed to pay you an income stream to enable you to enjoy a comfortable retirement. For most employees, 9.25% of a person’s gross income is paid into a super fund throughout their working lives, so this can end up being a substantial amount of money!Most super funds allow you to invest your money in a variety of asset classes – cash, fixed interest, property, and shares, both local or globally. There are a number of different types of super to choose from – retail Super, industry Super, self-managed Super and corporate Super, each one having their own advantages and disadvantages.

How much super do I need for my retirement?

According to research undertaken in February 2012 by the Association of Superannuation Funds of Australia (ASFA), a couple would need an annual net income of $56,236 for a comfortable retirement ($40,407 for a single person). This means you would need to accumulate a lump sum of around $850,000, which will allow you to retire at the age of 65 and provide that income until 87 years of age, after which the money runs out, based on 7% p.a. net return and annual income indexed by 3% (in today’s dollars). See http://www.superannuation.asn.au/resources/retirement-standard/

What are the tax advantages of super?

- Accumulation (saving) phase – 15% tax on contributions & earnings, 10% tax on capital gains.

- Pension (retirement) phase – Age 60 onwards – 0% tax on earnings, 0% tax on capital gains, 0% tax on withdrawals.

How much can I put into super?

- Tax deductible (concessional contributions) e.g. employer contributions, salary sacrifice, self-employed contributions – $25,000 a year or $35,000 a year (for over 60s from 2013-14 financial year and for over 50s from 2014-15 financial year onwards). If you exceed your concessional cap from the 2013/2014 year onwards, the federal government will allow you to withdraw any excess concessional contributions made from 1 July 2013 from your super fund. These excess concessional contributions will then be taxed at the individual’s actual marginal tax rate, plus an interest charge. Also people who earn more than $300,000 will be subject to an extra 15% contribution tax on concessional contributions made from 1 July 2012, a total of 30% tax.

- After-tax (non concessional contributions) – $150,000 a year, or $450,000 in a single contribution averaged over 3 years, with no tax payable. Above this taxed at 46.5%.

| When can I put money into super? |

|

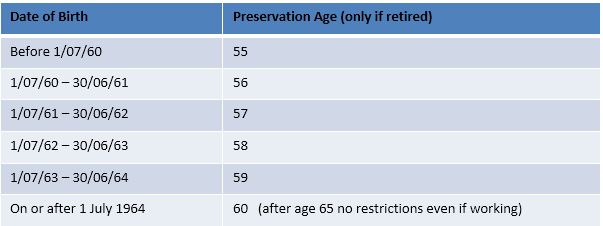

| When can I take money out of super? |

|

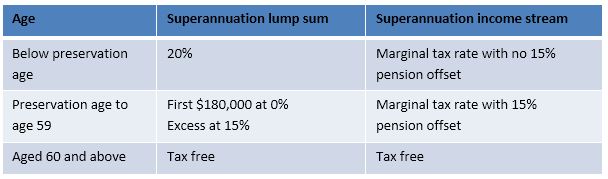

| Tax on withdrawals |

|

Tax on Death

- Tax-free to a spouse or dependent child.

- 15% or 30% tax to non dependents (depending on taxable components within super).

What else can my super do for me?

- Pays you a retirement income stream after retirement – tax-free after age 60.

- Can include Death and Total & Permanent Disability (TPD) Insurance to protect you and your loved ones.

- Can include income protection insurance to cover up to 75% of your income if ill or injured and help maintain your lifestyle.

- Can pay a tax-effective pension to your children in the event of your death.

- You may be eligible for a government co-contribution if making personal contributions and earning < $48,516.

- You may be able to pay off your mortgage faster with salary sacrifice contributions into super!

Types of Superannuation Funds

MySuper – MySuper is a new type of account that is offered by many superannuation funds. This fund will eventually replace existing default accounts offered by employer super funds (chosen by your employer if you didn’t choose one). MySuper offers lower fees, simple features (pay for what you want) and single or life stage investment options. These accounts are offered by retail, industry and corporate funds, but it will only be available for accumulation funds and not for defined benefit funds.

Retail Funds – Retail funds often have a large number of investment options and are usually recommended by financial advisers who may be paid for their advice by fees or a commission. These funds are easily accessible as anyone can join and are usually run by banks or investment companies. Retail funds are accumulative and range from mid to high cost, however some of these retail funds offer low cost or MySuper alternatives.

Industry Funds – Industry funds are not as easily accessible as retail funds because some of these funds are restricted to employees in a particular industry. However, some of the larger industry super funds are open for anyone to join. Most of these funds are accumulation funds, but a few older funds have defined benefit members. There are usually 5-15 investment options within these funds, which is sufficient to meet most people’s needs. Industry funds are generally low to mid cost funds although some have higher fees. All of the profits received from this fund are put back into the fund for the benefit of all members, as it is ‘not for profit’.

Public Sector Funds – Public sector funds are created for employees of Federal and State government departments and are mostly exclusive to government employees. These funds provide a modest range of investment choices and they generally have very low fees, while some also offer MySuper accounts. New members are usually in an accumulation fund while other long term members have defined benefit schemes. The profits are put back into the fund to benefit all members.

Corporate Funds – Corporate funds are arranged by an employer for its employees. Some of the larger corporate funds are employer sponsored funds, where employers operate the fund under a board of trustees appointed by the employees and employees. While other corporate funds are operated by a large industry super or retail funds. Corporate funds that are run by retail companies will usually retain some profits whereas the funds run by employers will return all the profits to its members. These funds will generally have a low to mid range cost structure for large employers, but may charge a higher cost for small employers. Most of these funds will have accumulation fund members while some older corporate funds may also have defined benefit members. There is usually a wide range of investments options if the fund is managed by a retail or industry fund.

Eligible Rollover Funds – An Eligible Rollover Fund (ERF) is a holding account for lost or inactive members with low account balances. These funds often charge higher fees with low investment returns. If you consolidate your ERF with an active super fund, your money is likely to grow faster.

Self-Managed Super Funds – Some people want the hands-on control that comes with having their own self-managed super fund (SMSF). With added control also comes added responsibility and workload. SMSFs can be suitable for people with a larger amount of super and solid skills in financial and legal matters. You must be prepared to research and monitor your super investments regularly if you want to manage them yourself effectively.

Setting up a SMSF involves abiding by strict rules regulated by the Australian Taxation Office (ATO). An SMSF can have between one to four members. Each member is a trustee (or director if there is a corporate trustee). Running your own fund is complex.

When you run your own SMSF you must:

- Carry out the role of trustee or director, which imposes important legal duties on you

- Use the money only to provide retirement benefits

- Set and follow an investment strategy that ensures the fund is likely to meet your retirement needs

- Keep comprehensive records and arrange an annual audit by an approved SMSF auditor

If you’re running an SMSF you will typically need:

- A large amount of money in the fund to make set up and yearly running costs worthwhile

- To budget for ongoing expenses such as professional accounting, tax, audit, legal and financial advice

- Plenty of time to manage the fund

- Financial experience and skills so you are more likely to make sound investment decisions

- Separate life insurance, including income protection and total and permanent disability cover

You can pay an adviser a fee to do the administration or help with the investment decisions for your SMSF. However, be sure you understand what your adviser is doing because you cannot pass on the responsibility of being a trustee or director.

Testimonials

My wife and I utilised Max’s services to review our life insurance policies, with particular respect to addressing an exclusion clause. Max spent significant time searching for the best possible solution and came up with a proposition that affordably met our requirements. I would not have been able to achieve this using one of those on-line insurance quote generators. Max did his utmost to get us the best deal and I would recommend him to anyone who is seriously looking to review their life insurance options.

Thanks Max for all your help with my new Life and Income Protection Policy. Not only have I got a better policy but a better premium as well. You answered all my questions and nothing was too much trouble. A pleasure dealing with you.

Insurance and the complexities of organising it has been made easy by Altura. Thanks Max for a painless process to organise what is an important aspect of any working person’s life. I have a great product within the price boundaries I gave and have the confidence that if I ever needed to claim, I have the full support of Altura to manage me through the process.

Max and Altura recently reviewed my superannuation and personal insurance circumstances. Upon reviewing my existing arrangements and analysing my personal needs, Max was able to outline a more cost-effective plan that saved money and was thereby likely to increase my return over time without compromising my personal coer. Max also took the time to make the process painless and simple and accommodate my busy schedule. Max is a true representative of customer service and operates a highly professional operation.

Max really took the time to understand my families needs and found a solution & cover that matched our situation and budget. His expertise, integrity and attention to detail were outstanding. He patiently followed up and answered each and every question with confidence and authenticity. I only wish all professionals conducted business in this manner. I can recommend Max to you enthusiastically and without reservation.

Max Pagnin from Altura Financial Planning provides outstanding knowledge and integrity in the field of personal insurance and income protection. Thanks to Max and Altura, my family was able to save over $5000 per annum on tax minimisation and through his detailed knowledge and support of my family’s needs for protecting our incomes, and the future of our children I can not thank Max enough, and highly recommend him to my entire network of family, friends and associates.

Max made a quite complex and daunting financial situation straightforward simple and not time consuming. Whilst finding me the best products and keeping my costs at a minimum, but with value, he stepped me through multiple options and was personable, friendly and punctual wiht good follow up.