Mortgage Protection Insurance vs. Income Protection Insurance

When people are considering the importance of income protection, some people believe that they have already taken out an income protection policy with their mortgage. However, after taking a closer look, they actually have mortgage protection insurance and not income protection.

It is inevitable that people can misunderstand what type of cover they have, what they may or may not be covered for, and who the benefit is designed to protect. This is due to the complexity of products such as income protection and mortgage protection insurance.

What is mortgage insurance?

Essentially, mortgage insurance is a protective measure the bank takes to reduce the risk of default. Mortgage protection insurance will pay you with monthly repayments if you are unable to pay the amount because of illness, injury or death.

How does mortgage protection insurance differ to income protection insurance?

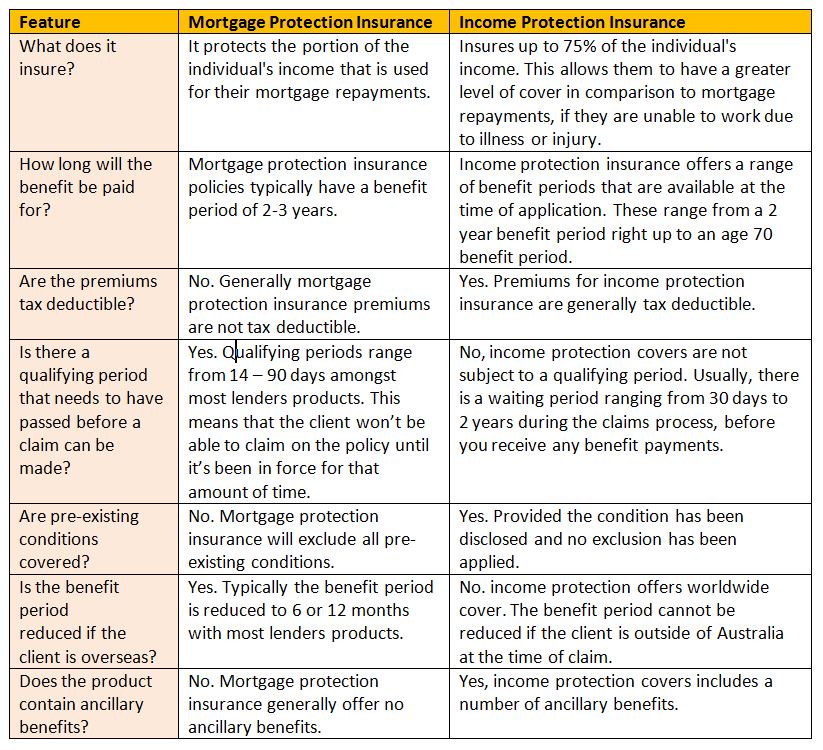

Mortgage protection insurance is designed to protect the portion of the your income that is used to pay the mortgage. Contrastingly, income protection can generally insure up to 75% of a persons income. Since your income services the mortgage payments (as well as other living expenses), income protection is able to provide you with a greater level of financial security, if the worst should occur. Other notable differences between these two insurances are:

In the unfortunate event that you need to make a claim on your policy, you will most likely find the range of expenses to be far greater than their mortgage repayments. These additional expenses render mortgage protection insurance inadequate. An income protection policy that replaces the large majority of your income should provide you with sufficient funds to meet your everyday living needs.

Summary

Mortgage protection insurance provides you with basic cover that focuses on one particular expense and is often designed to protect the lender and not the borrower. It is not a substitute for a quality income protection insurance policy. Income protection insurance is about protecting more than just the mortgage repayments. Covering up to 75% of your income and allowing you to protect your lifestyle, if you are unable to work as a result of illness or injury.

Testimonials

My wife and I utilised Max’s services to review our life insurance policies, with particular respect to addressing an exclusion clause. Max spent significant time searching for the best possible solution and came up with a proposition that affordably met our requirements. I would not have been able to achieve this using one of those on-line insurance quote generators. Max did his utmost to get us the best deal and I would recommend him to anyone who is seriously looking to review their life insurance options.

Thanks Max for all your help with my new Life and Income Protection Policy. Not only have I got a better policy but a better premium as well. You answered all my questions and nothing was too much trouble. A pleasure dealing with you.

Insurance and the complexities of organising it has been made easy by Altura. Thanks Max for a painless process to organise what is an important aspect of any working person’s life. I have a great product within the price boundaries I gave and have the confidence that if I ever needed to claim, I have the full support of Altura to manage me through the process.

Max and Altura recently reviewed my superannuation and personal insurance circumstances. Upon reviewing my existing arrangements and analysing my personal needs, Max was able to outline a more cost-effective plan that saved money and was thereby likely to increase my return over time without compromising my personal coer. Max also took the time to make the process painless and simple and accommodate my busy schedule. Max is a true representative of customer service and operates a highly professional operation.

Max really took the time to understand my families needs and found a solution & cover that matched our situation and budget. His expertise, integrity and attention to detail were outstanding. He patiently followed up and answered each and every question with confidence and authenticity. I only wish all professionals conducted business in this manner. I can recommend Max to you enthusiastically and without reservation.

Max Pagnin from Altura Financial Planning provides outstanding knowledge and integrity in the field of personal insurance and income protection. Thanks to Max and Altura, my family was able to save over $5000 per annum on tax minimisation and through his detailed knowledge and support of my family’s needs for protecting our incomes, and the future of our children I can not thank Max enough, and highly recommend him to my entire network of family, friends and associates.

Max made a quite complex and daunting financial situation straightforward simple and not time consuming. Whilst finding me the best products and keeping my costs at a minimum, but with value, he stepped me through multiple options and was personable, friendly and punctual wiht good follow up.